Top 50 Automation Companies of 2009

By Walt Boyes and Larry O'Brien

In 2008, we called it "Mr. Toad's Wild Ride," and we told you in 2009 that this year we'd have the "whole sorry story for you." Here it is.

From last year, we think the hallmark quote was from then-newly-appointed Honeywell CEO Norm Gilsdorf, "I don't think it is over quite yet, but the zombie is raising his arm from the grave."

The zombie is, in fact, rising. Honest. We swear.

The recession is by all accounts over, and the recovery is under way. Unfortunately, the recovery appears to be riding into town on the back of an elderly and very lazy tortoise. It reminds one of the old Three Stooges bit, "Sloooooowly I turned, step by step…"

The discrete automation suppliers were the first into the recession because of the huge trend of de-stocking, the shock to the automotive and durable goods industries, and customers putting off regularly scheduled maintenance during the downturn. However, they were also the first to recover as restocking efforts came online and scheduled maintenance and MRO activities were revived.

The process suppliers were the last to go into the recession and were able to eat through a large amount of project backlog that got them through the recession with less of an impact than the discrete suppliers felt.

However, the process suppliers were also the last to come out of the slump because they ate through their backlog and didn't have the new projects coming in to fill the pipeline. Now those projects are coming online, the pipeline is filling up again, and the process suppliers are recovering with a lag time of about six months compared to the suppliers who do a lot of discrete business.

Moving forward, the process suppliers will generate some good growth from the desperate need to modernize the installed base. In 2009, a lot of capacity was taken offline, end users postponed migration and modernization projects, and the market was flooded with spare parts. This gave users the opportunity to keep their old installed base afloat a little longer, and put off those modernization projects. All of this is building up to a huge requirement for modernization over the next several years.

2009 Numbers

The numbers we are using in this report are from 2009. This is so we can have normalized results to compare against each other. Companies release their full year results data on different schedules and at different times. This introduces nearly a whole year's lag in our report, but it is the only fair way to produce it.

The entire industry was hurt in 2009, and badly. From a total revenue of $87.6 billion in our last report, revenues plunged in 2009 to $77.8 billion—an incredible devaluation of more than 11% in a single year.

Light at the End of the Tunnel?

We can tell you, based on the reports some companies have released, their 2010 numbers (which will all formally appear in the December 2011 issue of this magazine) will show significant improvement over the numbers we are reporting here.

ABB, the second largest automation provider globally, released its results for the third quarter on Oct. 28. Third-quarter revenues were flat, but orders were up 16% for the quarter based on industrial automation and power orders. "We continued to take full advantage of the global industrial recovery in the third quarter with excellent order growth, slightly higher revenues, and, thanks to our cost take-out program, strong earnings as well," said Joe Hogan, ABB's chief executive officer, in the published release. "Our shorter-cycle automation businesses turned in a particularly positive performance on both the top and bottom line as they grew revenues on a much more competitive cost base."

Emerson Electric reported its 2010 fiscal year results on Nov. 2, announcing net sales increased 5%, with cash flow higher than 2008 results, albeit on lower sales and earnings. Emerson Process Management, the largest automation supplier in North America, which accounts for close to 26% of Emerson Electric's revenues, reported that, "Sales continued to strengthen and were up 5% in the (fourth) quarter. Underlying sales increased 5%, acquisitions added 1%, and unfavorable currency subtracted 1%. Orders strengthened in the trailing three-month period, driven by our strong global positioning and technology leadership. Segment margin increased to 19.1%, expanding 1.6 points from 17.5% in the prior year's quarter, driven primarily by cost reductions, lower restructuring expense and volume leverage," according to the released report.

In their "half-yearly report" released on Nov. 4, Invensys Chief Executive Ulf Henriksson reported, "Invensys Operations Management increased orders by 15% as we continue to win large greenfield control and safety projects in emerging markets. Its order book is at record levels at £1.0 billion, and its pipeline of current order prospects is around £4 billion. Revenue growth in the second half will increase as we convert recent large orders into revenue. We have also experienced a recovery in short-cycle equipment sales, particularly in North America. Taken together these have contributed to a significant improvement in operating profit and strong cash performance."

On Nov. 9, Rockwell Automation's Chairman and CEO Keith Nosbusch reported fourth quarter revenue up 26% year on year, with sales up 12% for 2010, and sales of the Logix platform (the Architecture and Software segment) up 36% in the fourth quarter compared to the fourth quarter of 2009.

Rockwell's closely watched process automation initiative, according to Nosbusch, was responsible for $700 million in revenue, up over 2009 and comparing favorably to 2008's record numbers. "The recovery has been sharper and faster than we expected," Nosbusch said. Rockwell's estimated 2011 earnings per share range from $3.80 to $4.20. That's significantly higher than 2010, but, according to CFO Ted Crandall, "our EPS estimate is consistent with a balanced view of the economic conditions."

Other companies are reporting increased sales, increased quotation activity and increased backlogs. This picture is a significantly different one than we painted last December. So, based on reports like these, we're likely to present you with a considerably rosier portrait of the automation industry a year from now.

Making Hay

Some companies used the new, lower valuation of the market to snap up some bargain-priced acquisitions. For example, ABB snapped up K-Tek, Emerson picked up Roxar, Honeywell picked up RMG, and, in a whang-dang-doodle of an acquisition, GE bought Dresser, including Masoneilan, the second largest manufacturer of control valves.

In addition, all of the automation vendors did restructuring, downsizing and layoffs. However, none of the bigger-fish-eat-big-fish acquisitions, such as the rumors of an acquisition of Rockwell by ABB, materialized. Company managements realized that the costs of large acquisitions are much higher in the reorganizations and company culture shifts that accompany those sizeable deals, than they wanted to pay in a very deep recession. Like ABB's purchase of K-Tek, most of the acquisitions were to plug a hole in the product portfolio.

How Do We Do It?

Every year, we find more companies to add to the list. If you spot one we haven't listed and that should be, let us know. Even though we add companies and subtract the ones that have been acquired, we haven't changed our basic methodology of analysis for the past several years.

Here's what we are including in our definition of the 50 largest companies:

- Process automation systems and related hardware software and services

- PLC business, as well as related hardware, software, services, I/O and bundled HMI

- Other control hardware components, such as third-party I/O, signal conditioners, intrinsic safety barriers, networking hardware, unit controllers and single- and multi-loop controllers

- Process safety systems

- SCADA systems for oil and gas, water and wastewater, and power distribution

- AC drives

- Motion control systems

- Computer numerical control (CNC) systems

- Process field instrumentation, such as temperature and pressure transmitters, flowmeters, level transmitters and associated switches

- Analytical equipment, including process electrochemical, all types of infrared technology, gas chromatographs for industrial manufacturing and related products

- Control valves, actuators and positioners

- Discrete sensors and actuators

- All kinds of automation-related software, from advanced process control, simulation and optimization to third-party HMI, plant asset management, production management (MES), ERP integration packages from the major automation suppliers and similar software

- Other automation-related services provided by automation suppliers

- Condition-monitoring equipment and systems

- Ancillary systems, such as burner management systems, quality control systems for pulp and paper, etc.

What we are not including:

- Pumps and motors

- Robotics

- Material-handling systems

- Supply chain management software

- Building automation systems

- Fire and security systems

- Processing equipment such as mixers, vessels, heaters, etc., as well as process design licenses from suppliers that have engineering divisions

- Electrical equipment, such as low-voltage switchgear, etc.

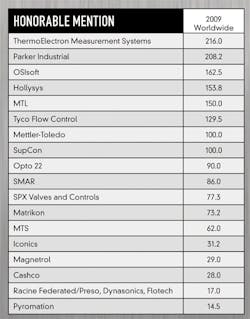

Also, there also are companies we're watching that are not yet in the Top 50, and we've made them "'Honorable Mentions." Some, like Opto22, made the North American list, but aren't yet large enough to make the global list. Others, like Supcon and Hollysys (both rom China) are just making the list. This is truly becoming a global business.

See the Top 50 Global Automation Vendors

See the Top 50 NORTH American Automation Vendors

Walt Boyes is Control's editor in chief. Larry O'Brien is a research director at ARC Advisory Group.